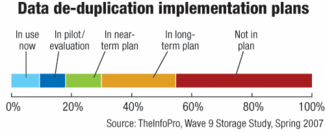

The latest study from TheInfoPro (TIP) research firm has revealed that data de-duplication is the top storage technology in the adoption plans of Fortune 1000 organizations, while the same enterprises say data archiving and archive management issues are keeping their storage professionals up at night. Meanwhile, storage capacity growth is still through the roof despite poor utilization rates on existing hardware.

TIP’s recently released Wave 9 Storage Study was based on a series of interviews with more than 150 Fortune 1000 end-users and details technology adoption trends and timeframes, management practices, and vendor performance data for the storage industry. Approximately 50% of the study participants cited data de-duplication as the top storage technology in consideration for 2007 and 2008. The study results indicate a rise in the number of backup redesign projects as the driving force behind the rise in de-duplication adoption.

Robert Stevenson, TIP’s managing director of storage research, says backup activities take up the second-largest amount of a Fortune 1000 storage professional’s time. And, with staffing levels remaining flat and the ever-present budgetary pressure to cut costs, re-architecting the backup process and eliminating redundant data are being viewed by large enterprises as viable options for freeing up manpower.

But there’s a catch: Data de-duplication, which is still a nascent technology, is coming up short in terms of scalability. Stevenson says the average size of a de-duplication repository is approximately 10TB, which equates to a compressed repository of 2TB to 5TB. That’s just not big enough.

“Most [Fortune 1000] users want to grow their repositories up to the 300TB range because they back up that amount of data to tape every month. There is an air of frustration when it comes to scalability. Users want to maximize their resources and scale the de-dupe repository to match their actual tape workload, but they can’t get there right now,” says Stevenson.

Data de-duplication is the “hottest” storage networking technology in the buying plans of the Fortune 1000, followed by 4Gbps Fibre Channel and virtual tape libraries (VTLs).

The top-two de-duplication vendors cited by TheInfoPro study participants were EMC, followed by Data Domain.

Capacity Waste Abounds

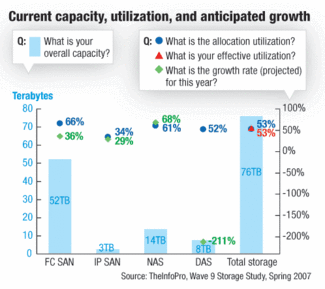

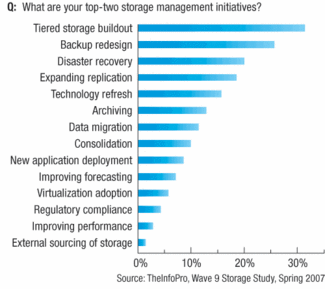

The pain doesn’t begin and end with backups. The TIP study also shows that, on average, only 46% of the existing storage capacity in Fortune 1000 data centres-which now average more than 1PB in size-is being utilized. Stevenson says business expansion projects will continue to fuel capacity growth by more than 36% per year. Server consolidation, server virtualization, regulatory compliance, and disaster-recovery projects are also driving the anticipated growth.

According to the study, NAS is expected to see the highest capacity increase this year, growing by approximately 41%. IP SANs and Fibre Channel SANs are expected to see growth rates of 39% and 37%, respectively. In addition, organizations that have dedicated a tier of storage to archiving indicate that archive content represents 24% of their entire current storage capacity and has an anticipated growth rate of 52%.

SANs are the biggest offenders when it comes to capacity waste. More than 40% of current SAN capacity is unused, according to Stevenson.

Archiving Tools In Demand

Setting aside disk space for archive data also adds to capacity growth. About 12% of the end-users interviewed by TheInfo-Pro listed archiving as one of their top storage initiatives, and 25% listed poor archiving capabilities as one of the key reasons for storage growth. According to the study, the average Fortune 1000 enterprise has more than 250TB of storage space dedicated to archive-related content. The capacities of these archive tiers are anticipated to grow 52% by the end of 2007 as organizations build out archiving tiers, increasing the average from three to four classes of storage.

Stevenson says archiving data and intelligent data classification are coming to the forefront of data management issues because of legislative and industry-specific standards for data retention set in place by the federal government.

“As a result, creating an efficient, long-term e-mail, application, and e-discovery storage methodologies have become critical for Fortune 1000 organizations- and even more troublesome in smaller companies-as many applications, both legacy and new, have limited archiving capabilities,” says Stevenson.

The result is a huge jump in demand for archiving-related management products. The study ranks information lifecycle management (ILM) technologies as the top storage management technology in the buying plans of the Fortune 1000, with structured data-classification tools and e-mail archiving software ranked second and third, respectively.